3 Pie Charts that Present Fragmentation within the U.S. | U.S. Finance Information

We’ve executed a few blogs this yr wanting on the increase in off-exchange trading, and fragmentation of what’s on-exchange, at the same time as on-exchange share continues to shrink.

Immediately, we replace one of our favourite charts, which seems to be at how orders route, the place trades really get executed and what financial incentives every half of the market construction pies use to draw clients.

You would say the U.S. equity market is admittedly more like three interconnected markets, with a lot of retail, mutual funds and arbitrage merchants largely separated from one another – leading to much less “accessible” liquidity, out there to every, than top-line quantity numbers recommend.

The U.S. market works more like three separate markets

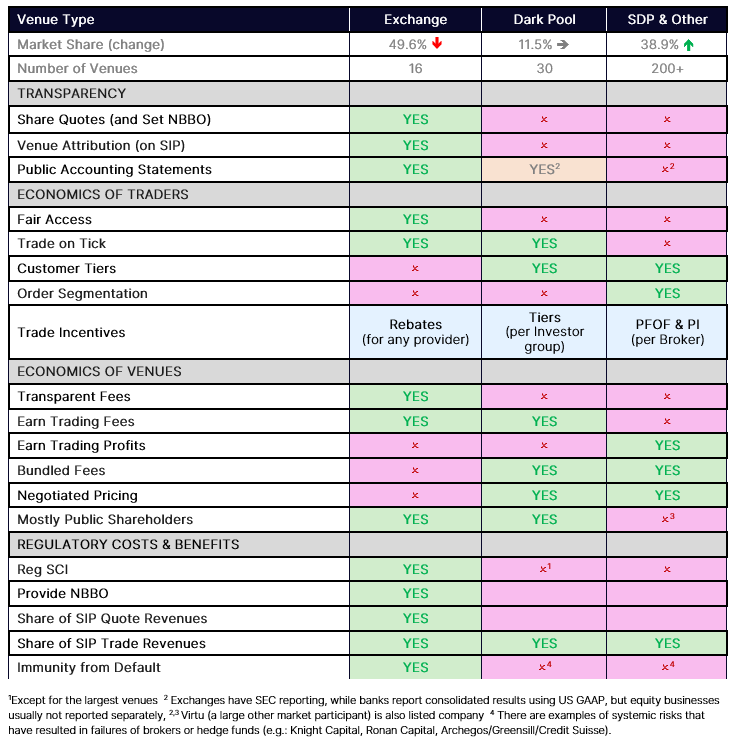

The chart beneath reveals the newest market shares of every pie within the U.S. market construction. The circles are sized relative to their contribution to market-wide volumes traded. Once we first made this chart practically 5 years in the past, 65% of complete market quantity was executed on-exchange. As more quantity has moved away from lit markets, the economics of trading have modified, too.

As we element beneath, the market guidelines, trading economics, and how orders are handed by brokers, means every pie really works fairly in a different way to the others.

Chart 1: Order circulation and market share within the U.S. stock market

The foundations for every half are fairly totally different

The foundations and conventions for trading throughout every of the three pies are fairly totally different, too.

1. Largely Retail Pie

We are saying that is “mostly retail” as a result of it contains all types of bilaterally agreed trades. That features trades between Single Vendor Platforms, different brokers, in addition to blocks agreed between buyers. Nonetheless, based mostly on work we (and others) have executed taking a look at retail trading growth, retail appears to be the most important half of this pie, however we acknowledge that it’s not the one exercise driving the growth of off-exchange.

Orders from retail brokers are often despatched to wholesalers. As a result of retail orders are small, and sometimes pretty random, it’s simpler to revenue from filling a retail unfold crossing order than an arbitrage unfold crossing order.

As a outcome, retail sometimes will get stuffed earlier than reaching exchanges, often with sub-decimal costs which might be higher than the restrict orders darkish swimming pools and exchanges are required to make use of.

This leads to an financial incentive, known as price enchancment, to trade more with this pie. Typically, wholesalers will even pay for order circulation that’s significantly profitable to trade with.

2. Darkish Swimming pools Pie

Funding banks sometimes deal with mutual fund buyer trades and construct algorithms to slice their giant orders up to reduce their influence. In addition they often run their own darkish swimming pools to cross these buyer orders away from exchanges.

In contrast to how retail trade, darkish swimming pools need to trade “on tick” (or, steadily, at midpoint). They do that utilizing the NBBO from exchanges.

This not solely helps brokers keep away from exchange charges, however it additionally earns them trading and SIP knowledge revenues.

As well as, the flexibility to phase additionally means some clients can have higher unfold seize, which implies they’re prepared to pay larger charges to trade.

Nonetheless, each these pies are, by their nature, not clear. Moderately than set costs, they use NBBO costs. As well as, their charges could be very totally different, and trades are generally free or bundled with different providers. Even the place trades are occurring is nameless on the SIP (Though FINRA does report mixture market share with a two-to-four-week lag).

3. Exchanges Pie

As soon as liquidity is exhausted in both of the broker run swimming pools above, orders will fall into the “public” markets.

Identical to darkish swimming pools, exchanges need to trade on tick (or at midpoint). Nonetheless, in contrast to darkish swimming pools, exchanges are truthful entry markets, that means they’ll’t discriminate on who can trade on their venue or phase clients into tiers based mostly on profitability to different merchants. Though issues like velocity bumps and costs and rebates do have an effect on trading economics, which is why some venues obtain orders.

One thing a lot of pundits appear to neglect is that Exchanges are additionally important to the entire ecosystem for different causes. Exchanges publish their best costs, that are then used all through the industry to guard buyers from dangerous fills. Some additionally listing and supply needed providers for public corporations that need entry to public markets.

Desk 1: The foundations for trading in every pie are fairly totally different

The U.S. has a very fragmented, and segmented, market

What the info reveals just isn’t solely that the U.S. stock market is extraordinarily fragmented, however it is usually segmented on the level of order arrival.

This impacts the economics of offering “positive externalities” like bringing more IPOs to market and offering costs to guard buyers. It transfers the economics of trading and unfold seize from these offering the NBBO to these trading first in segmented venues. It reduces the precise liquidity that’s accessible to everybody. It’s additionally arduous for retail and Institutional buyers to trade immediately with one another.

Not solely is the U.S. market construction difficult. It’s removed from a stage enjoying subject.

Keep up to date with the latest news within the US markets! Our web site is your go-to source for cutting-edge financial news, market trends, financial insights, and updates on home trade. We offer each day updates to make sure you have entry to the freshest data on stock market actions, commodity costs, currency fluctuations, and main financial bulletins.

Discover how these trends are shaping the long run of the US financial system! Go to us often for probably the most partaking and informative market content material by clicking right here. Our rigorously curated articles will keep you knowledgeable on market shifts, investment methods, regulatory modifications, and pivotal moments within the US financial panorama.