Why NBBO Economics Have Turn into Distorted | U.S. Finance Information

We just lately studied how trades pace across the market — usually ranging from a broker order in Secaucus, touring on the pace of fiber to take orders on exchanges across the market, then inflicting a response operate on the pace of microwave.

As we speak, we’re how quote updates usually circulate across the market.

What we discover is that major itemizing exchanges set the new Nationwide Finest Bid and Provide (NBBO) most of the time. Then, most venues see orders arriving at a pretty constant charge over time, however some venues have a fast increase in quotes on the new NBBO within the primary millisecond.

Whether or not that’s good or unhealthy for market construction and routers is an attention-grabbing query.

Itemizing venues set probably the most NBBOs

We have a look at who units new NBBOs utilizing venue timestamps throughout all exchanges. That removes any delays reporting new trades back to the SIP.

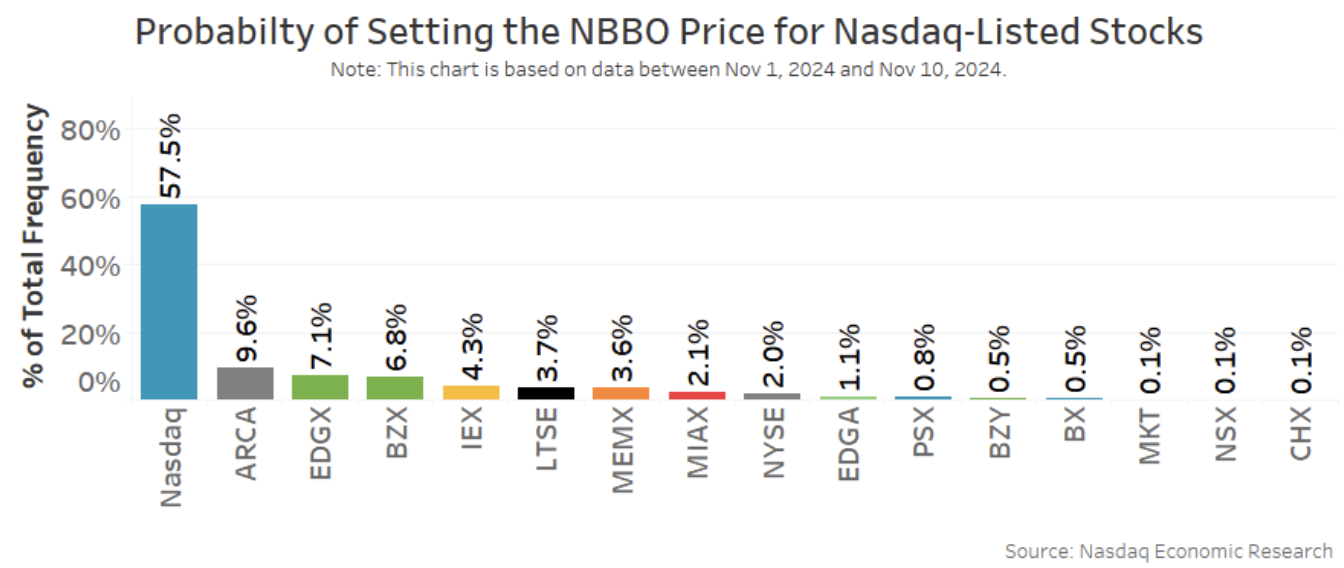

We see that major exchanges set the new NBBO the bulk of the time. That shouldn’t be shocking, as major exchanges additionally need to compete for company listings, and firms examine them based mostly on issues that cut back their prices of capital, corresponding to constant quotes and tight spreads.

For instance, Nasdaq market makers set quotes in Nasdaq-listed shares close to 58% of the time. In distinction, all different exchanges mixed improve the NBBO for Nasdaq shares much less than 43% of the time.

Chart 1: Extra than half of the time new NBBO price is set by the first itemizing exchange

Different venues be part of NBBO at totally different charges and speeds

What does are likely to occur more persistently is that different venues be part of (or copy) the NBBO costs which were set on the first.

Importantly, we don’t see all venues dashing to repeat the NBBO quotes at precisely the pace of gentle. As an alternative, most exchanges see a constant arrival of new orders as time (x-axis) progresses.

However there are a few attention-grabbing exceptions:

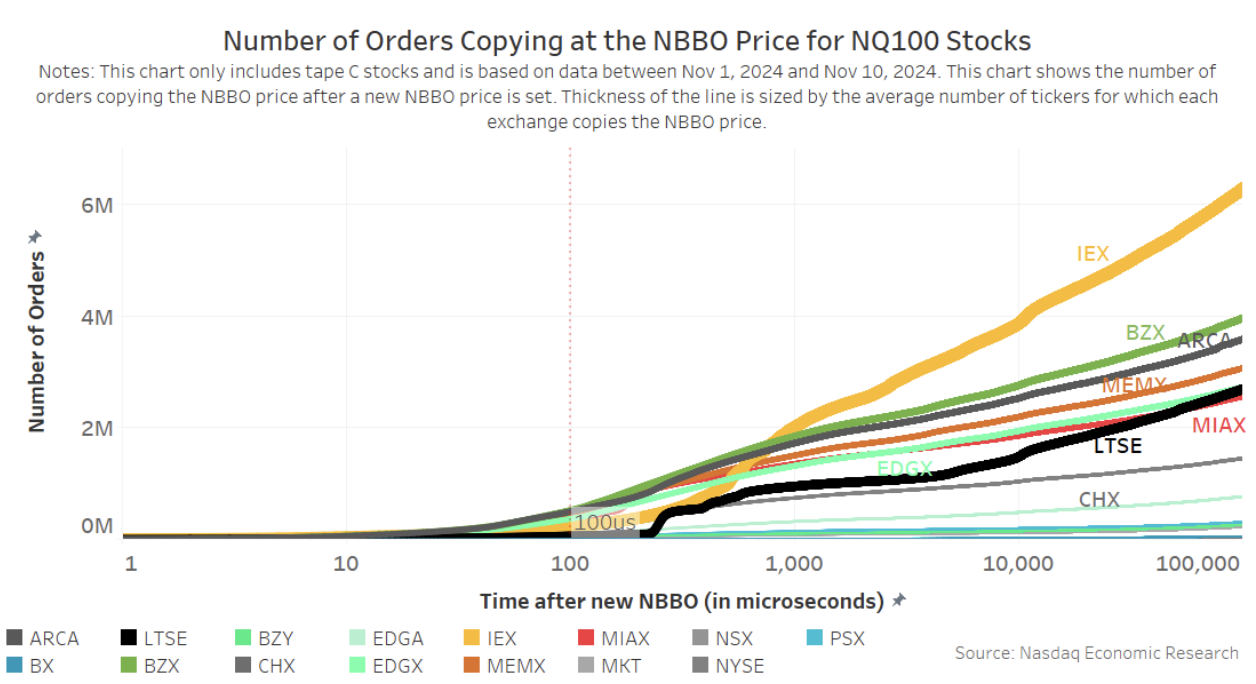

- Sharp jumps show a fast copying of new quotes. LTSE, and later IEX, stand out, with each having a sharp bounce in copy quotes each properly within 1 millisecond.

- Top of the road exhibits that IEX stands out, particularly for more liquid shares within the Nasdaq-100 (Chart 2a), the place it has more quotes copying the NBBO than some other exchange — by a vital margin — regardless of a number of different exchanges really offering the market with more liquidity (ARCA, EDGX and BATS).

- Line thickness exhibits the breadth of shares within the universe the place quotes are copied. IEX and LTSE stand out again, with copy-quotes on far more shares, giving the looks of widespread liquidity to buyers, particularly versus their trading market share (Chart 3).

Chart 2a: IEX ship orders copying NBBO quotes for liquid (Nasdaq-100) shares

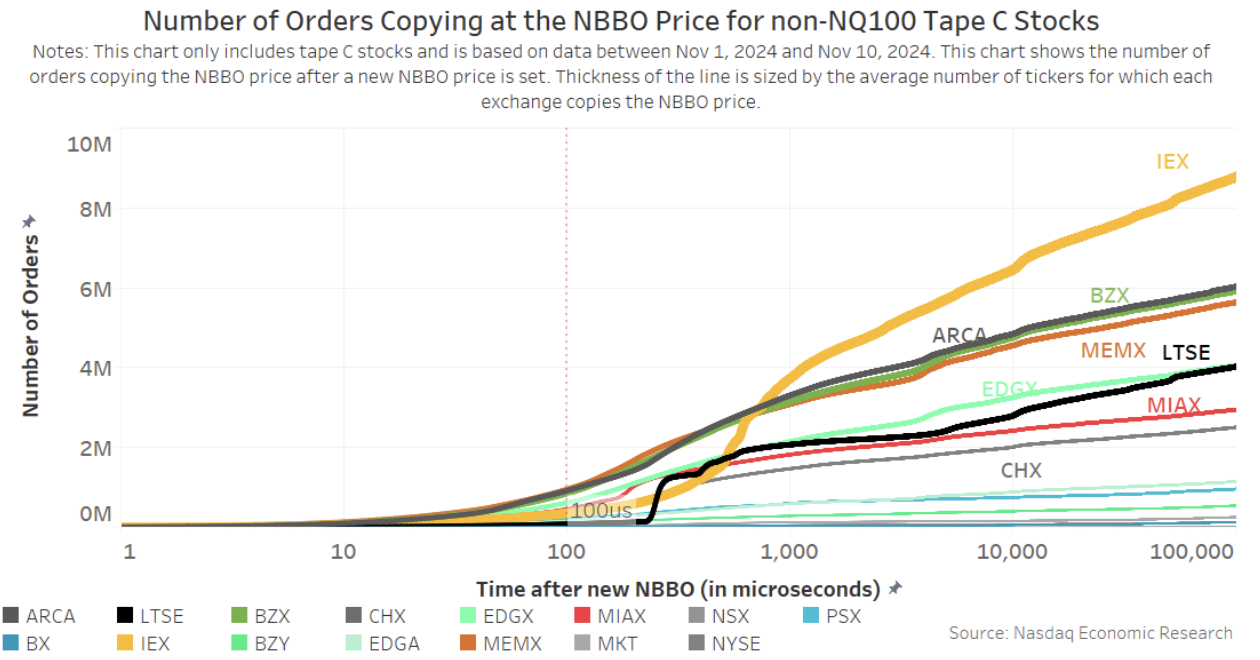

Apparently, the patterns change little or no after we have a look at much less liquid shares.

Given there are about 3,300 firms within the chart beneath (versus simply 100 within the chart above), the increase in complete quotes is comparatively small. It is most likely true that, with these smaller firms, they’re additionally much less profitable to cite. However these are additionally the tickers that need liquidity help probably the most. Even the SIP income allocation method is tilted in favor of quotes in these shares.

What the information exhibits is that for these much less liquid shares, IEX and LTSE skilled an even sharper bounce within the quantity of copying quotes. Nevertheless, as you will notice in Chart 3, these massive numbers of quotes don’t ultimately result in trades.

Chart 2b: There may be much less curiosity in copying quotes for much less liquid, smaller-cap, shares

Is that this good or unhealthy for market construction?

This issues in numerous methods to totally different members.

For brokers and merchants, it reduces the unique need for pace to be on the high of the queue. That’s as a result of, as long as you’ll find a venue with no order on that venue, you will be on the high of their queue. That, in flip, helps increase unfold seize and profitability for merchants on these exchanges.

However fragmentation provides different prices for brokers, together with more connections and more difficult routing. It additionally provides prices to buyers by means of larger alternative prices.

There are different prices of diluting queue precedence, too.

The system doesn’t reward aggressive quotes that result in trades

Extra importantly, fragmentation of quoting is unhealthy for the market makers really setting the quotes within the first place. Their business is to revenue from unfold seize, however copy quotes make that much less possible.

Maybe even worse, the best way regulated knowledge economics works within the U.S. provides to inefficiencies. The SIP income allocation method was designed to reward quotes and trades “equally” regardless of who set these costs more usually. Again earlier than there have been over a dozen exchanges, with some protected quotes utilizing pace bumps, it was set up to reward all quotes equally.

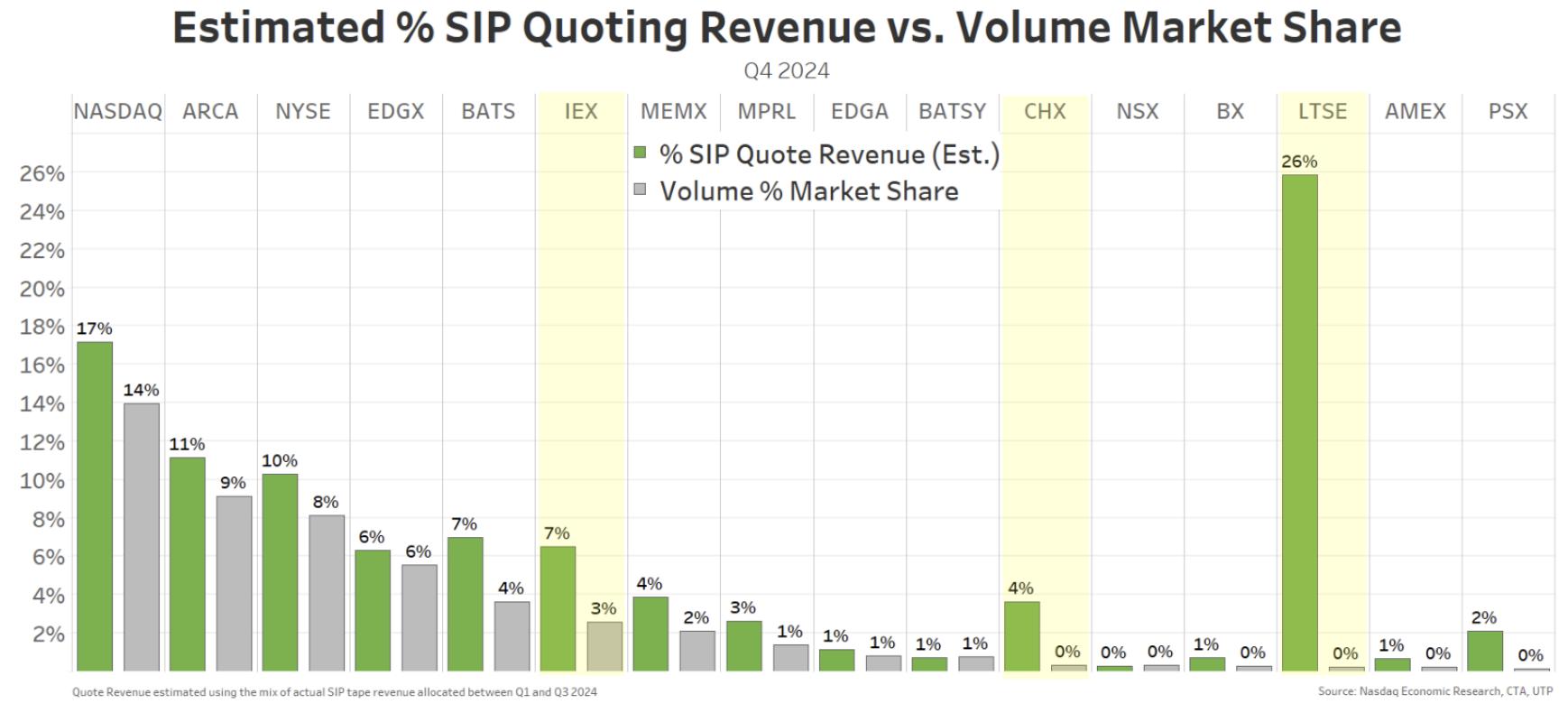

Taking a look at current SIP income exhibits that some exchanges appear to earn a lot of quote revenues, with out really doing any trading. In some exchanges, there are clear prices to exchanges, like rebates, to reward market makers offering these quotes, however in different instances the associated fee to exchanges and advantages to market makers are much less clear.

Chart 3: LTSE and IEX ship massive quantity of orders copying the NBBO quotes

SIP quote revenues can add to tens of hundreds of thousands of {dollars} for some exchanges. That is an synthetic incentive that helps fragmentation, with out really making the market more aggressive and cheaper for buyers.

We need to make sure the NBBO is nice at defending buyers and issuers

Most of us appear to agree that the NBBO is important for buyers and issuers. Educational analysis additionally means that tight spreads cut back prices of capital and increase liquidity. That, in flip, helps make the U.S. market more enticing than many markets across the world.

We spend a lot of time arguing about the advantages of a “public” and reasonably priced NBBO. Maybe we additionally need to make sure that the economics additionally pretty reward the venues and merchants setting these quotes. That would even help make markets more environment friendly.

Keep up to date with the latest news within the US markets! Our web site is your go-to source for cutting-edge financial news, market trends, financial insights, and updates on home trade. We offer each day updates to make sure you have entry to the freshest data on stock market actions, commodity costs, currency fluctuations, and main financial bulletins.

Discover how these trends are shaping the longer term of the US financial system! Go to us commonly for probably the most participating and informative market content material by clicking right here. Our fastidiously curated articles will keep you knowledgeable on market shifts, investment methods, regulatory adjustments, and pivotal moments within the US financial panorama.