European Exceptionalism? | Nasdaq | U.S. Finance Information

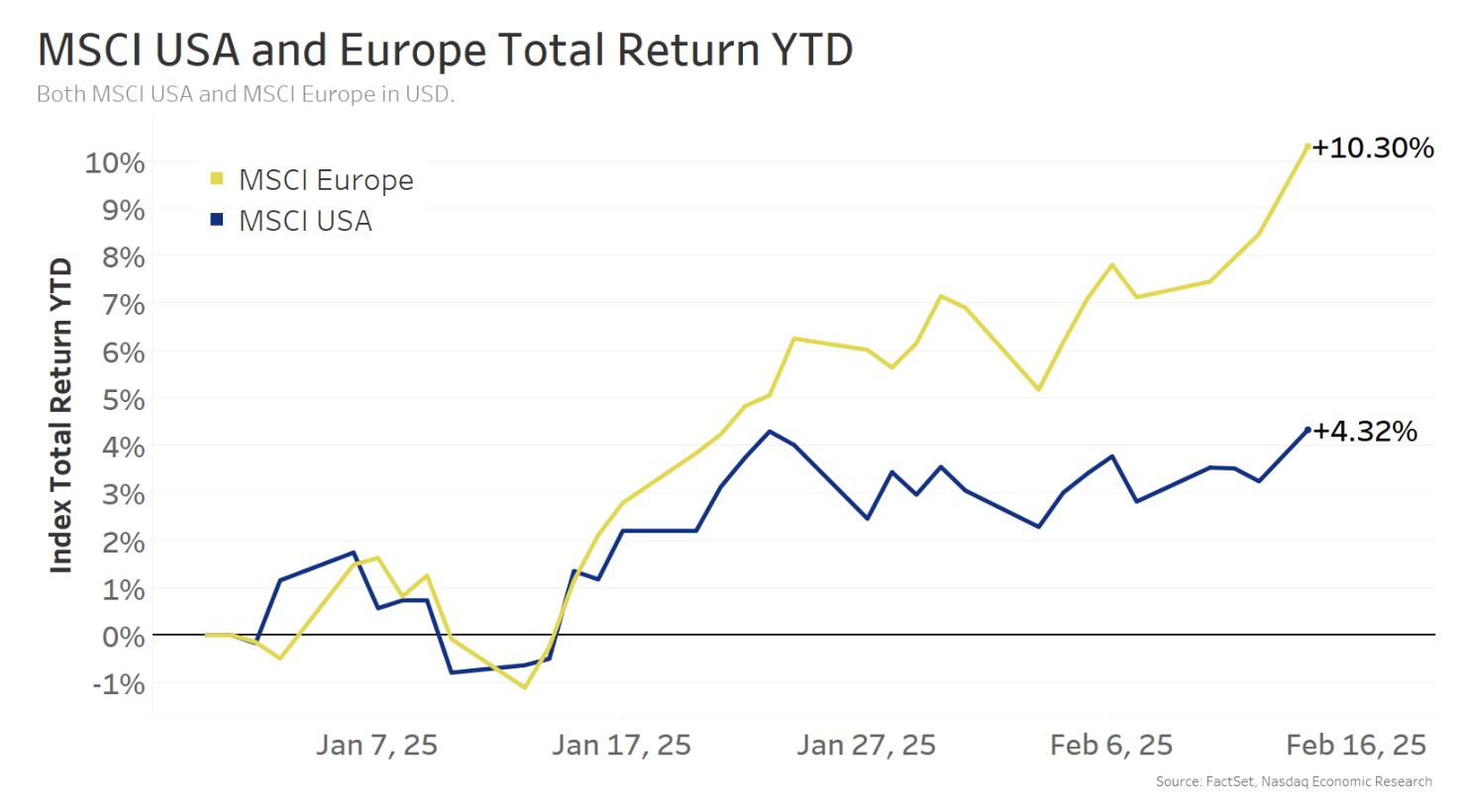

After 2 years of US Exceptionalism, Europe shares +10% YTD vs. +4% for the US

For the final couple years, the story for equities globally has been one of “US Exceptionalism,” the place US shares have considerably outperformed different markets, largely because of the US-based (and Nasdaq-listed) Magazine 7.

Over 2023 and 2024, US equities gained +59% – more than double Europe’s +24% gain (each measured by the MSCIindices of giant and mid caps).

To begin 2025, although, the US hasn’t been so distinctive.

In truth, it’s Europe that’s doubling up the US, with the MSCI Europe up +10% (chart beneath, gold line), in comparison with +4% for the US (blue line).

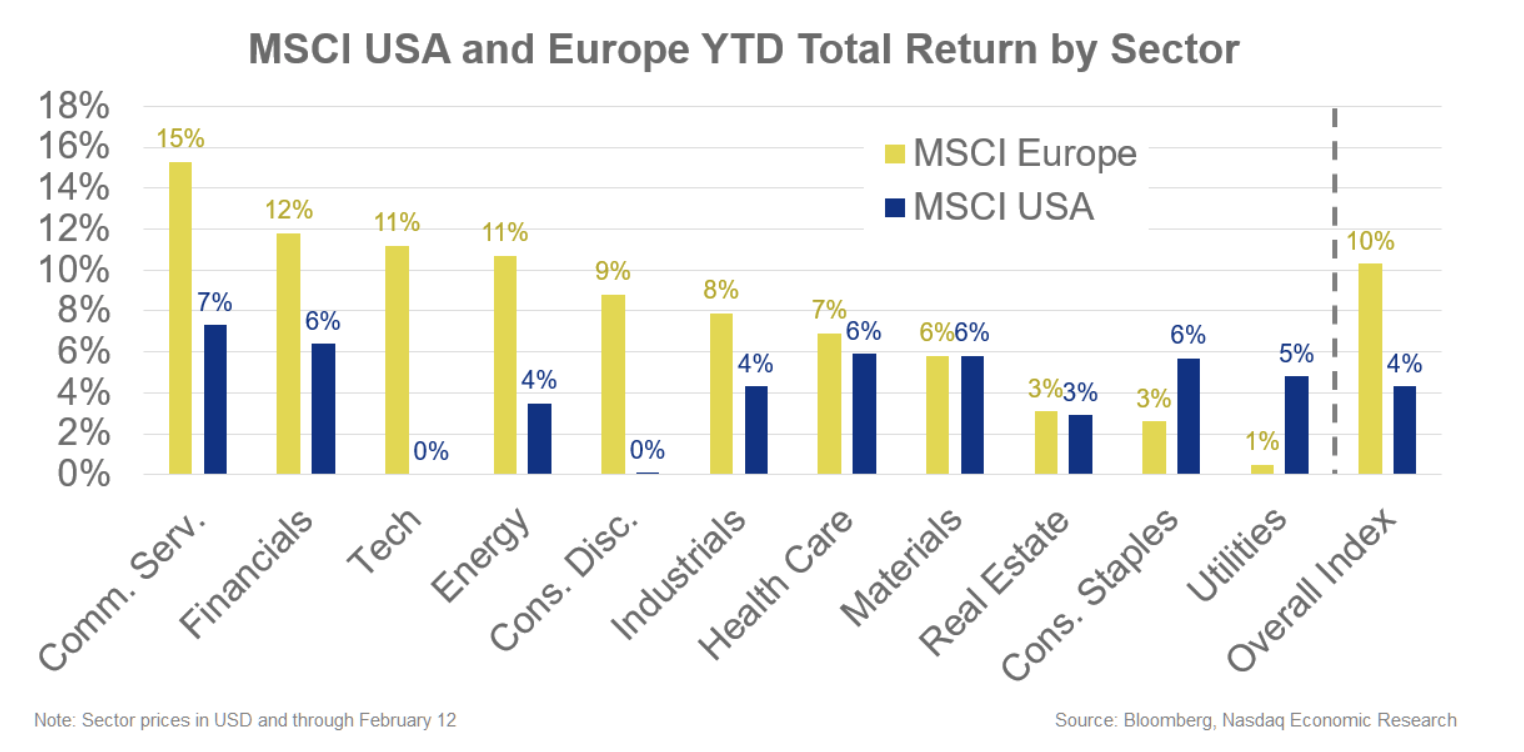

Europe’s lead is broad based mostly, beating the US throughout 7 of 11 sectors, tied in 2 more

And it’s not only one factor driving it. If we have a look at returns this yr by sector (chart beneath), Europe (gold bars) is thrashing the US (blue bars) in 7 of 11 sectors, and so they’re primarily tied in two more (Supplies and Actual Property).

So Europe’s management is broad based mostly.

AI publicity, higher-for-longer charges, and “expensive” valuations larger headwinds for US

There are a few totally different causes the US has lagged Europe:

- US a lot more uncovered to AI. Tech is 40% of the MSCI USA in comparison with simply 10% for Europe. For the final 2 years, this favored the US, with AI optimism serving to the Magazine 7 gain +156%. However the Magazine 7 is flat this yr, partly as a result of DeepSeek’s low price, high efficiency model tempered that AI optimism (and the knowledge of Large Tech’s deliberate $300bn spending on AI this yr). Europe, although, is tilted more in the direction of Financials, Well being Care, and Industrials.

- US dealing with higher-for-longer charges as Europe cuts. Markets are solely pricing 40bps in Fed cuts this yr, in comparison with 120bps from the European Central Financial institution (together with the 25bps cut they already did). So the European economic system is predicted to get more of a increase from fee cuts.

- Europe “cheap” relative to US. The US’s Value/Earnings valuation ratio is over 22 – close to file highs during Covid and the Dotcom bubble – whereas Europe’s PE is simply over 14 – close to its 20-year average and about two-thirds the US’s PE. So Europe shares are comparatively “cheap” in comparison with the US. Plus, increased charges (#2) make it tougher to maintain high PEs since increased borrowing prices make future earnings tougher to understand.

- European earnings recession over. After seeing earnings fall -2% in 2024, the MSCI Europe is predicted to see earnings rise +7% this yr. Although that trails the US’s projected +13% earnings gain.

Nonetheless, outdoors of the dimming of AI optimism, most of these elements have been already in place to begin the yr.

So, it’s more a story of Europe recovering (after gaining simply +2% final yr) than the US slowing down. In any case, the MSCI USA is just under its all-time high (set in January), and a +4.3% gain in six weeks isn’t too dangerous.

The knowledge contained above is offered for informational and academic functions solely, and nothing contained herein needs to be construed as investment advice, both on behalf of a explicit security or an total investment strategy. Neither Nasdaq, Inc. nor any of its associates makes any suggestion to buy or promote any security or any illustration in regards to the financial situation of any company. Statements relating to Nasdaq-listed firms or Nasdaq proprietary indexes usually are not ensures of future efficiency. Precise outcomes might differ materially from these expressed or implied. Previous efficiency isn’t indicative of future outcomes. Buyers ought to undertake their own due diligence and thoroughly consider firms earlier than investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.

Keep up to date with the latest news within the US markets! Our web site is your go-to source for cutting-edge financial news, market trends, financial insights, and updates on home trade. We offer every day updates to make sure you have entry to the freshest data on stock market actions, commodity costs, currency fluctuations, and main financial bulletins.

Discover how these trends are shaping the long run of the US economic system! Go to us recurrently for essentially the most participating and informative market content material by clicking right here. Our rigorously curated articles will keep you knowledgeable on market shifts, investment methods, regulatory modifications, and pivotal moments within the US financial panorama.