Purchase Gilead Sciences (GILD) Inventory at 52-Week Highs? | U.S. Finance Information

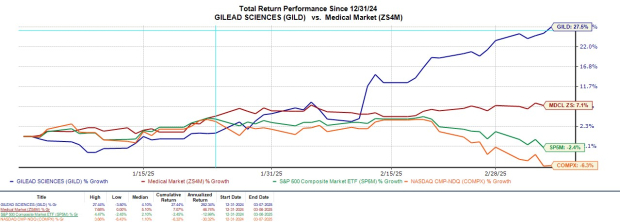

Medical pioneer Gilead Sciences GILD has seen its stock etch out new 52-week highs because the broader market pulled back sharply in current weeks. Gilead has joined Johnson & Johnson JNJ, and a cluster of healthcare shares which have risen to contemporary peaks.

This makes it a worthy matter of whether or not Gilead’s stock can attain larger highs with traders scoping out publicity to the medical sector amid financial uncertainty. Buying and selling at $117 a share, GILD has spiked practically +30% 12 months up to now with the broader market indexes in unfavorable territory.

Picture Supply: Zacks Funding Analysis

Gilead’s Business Management

Engaged within the development of medicines to forestall and deal with life-threatening illnesses, Gilead is the chief in developing medicine for the therapy of HIV . The pharmaceutical giant additionally has an in depth portfolio of medicine for liver illnesses, irritation/respiratory illnesses and hematology/oncology.

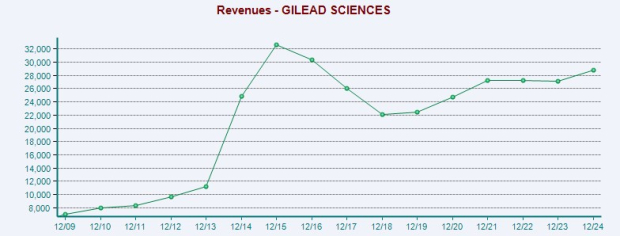

Bringing in $28.75 billion in 2024, Gilead’s prime line is anticipated to dip 1% this 12 months however is projected to rebound and rise 4% in fiscal 2026 to $29.7 billion.

Picture Supply: Zacks Funding Analysis

Gilead’s EPS Development

Extra intriguing, Gilead’s operational effectivity has led the company and its stock back to prominence. Gilead’s annual earnings are anticipated to soar 70% in FY25 to $7.87 per share in comparison with EPS of $4.62 final 12 months. Plus, FY26 EPS is projected to increase one other 5%.

Picture Supply: Zacks Funding Analysis

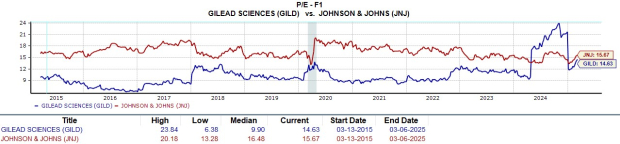

Monitoring Gilead’s P/E Valuation

At present ranges, GILD nonetheless trades at a very cheap 14.6X ahead earnings a number of which is barely beneath Johnson & Johnson’s 15.6X. GILD additionally trades at a noticeable low cost to its Zacks Medical-Biomedical and Genetics Business average of 19.1X with the benchmark S&P 500 at 21.6X.

Picture Supply: Zacks Funding Analysis

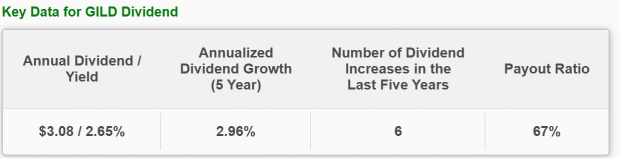

Gilead’s Beneficiant Dividend

Furthering preserving traders engaged in Gilead’s stock as a defensive hedge is its 2.65% annual dividend yield. This tops the benchmark’s 1.27% average and its industry average of 1.49%.

Picture Supply: Zacks Funding Analysis

Backside Line

Regardless of such a sharp YTD rally, Gilead Sciences stock sports activities a Zacks Rank #2 (Purchase). At 52-week peaks there may nonetheless be more upside for GILD shares as FY25 and FY26 EPS estimates have trended larger within the final 30 days.

Moreover, traders should be compelled to buy GILD as a hedge towards current market volatility, particularly contemplating Gilead’s EPS growth, industry management, and cheap P/E valuation.

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the dimensions of NVIDIA which skyrocketed more than +800% since we really useful it. NVIDIA continues to be robust, however our new prime chip stock has a lot more room to growth.

With robust earnings growth and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Inventory Now for Free >>

Need the latest suggestions from Zacks Funding Analysis? At present, you may obtain 7 Greatest Shares for the Subsequent 30 Days. Click on to get this free report

Gilead Sciences, Inc. (GILD) : Free Inventory Evaluation Report

Johnson & Johnson (JNJ) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

Keep up to date with the latest news within the US markets! Our web site is your go-to source for cutting-edge financial news, market trends, financial insights, and updates on home trade. We offer every day updates to make sure you have entry to the freshest info on stock market actions, commodity costs, currency fluctuations, and main financial bulletins.

Discover how these trends are shaping the longer term of the US financial system! Go to us recurrently for essentially the most partaking and informative market content material by clicking right here. Our fastidiously curated articles will keep you knowledgeable on market shifts, investment methods, regulatory modifications, and pivotal moments within the US financial panorama.