February 2025 Evaluation and Outlook | U.S. Finance Information

Govt abstract:

- U.S. equity indices closed decrease in February

- Progress/stagflation worries with softer financial readings and warmer inflation indicators

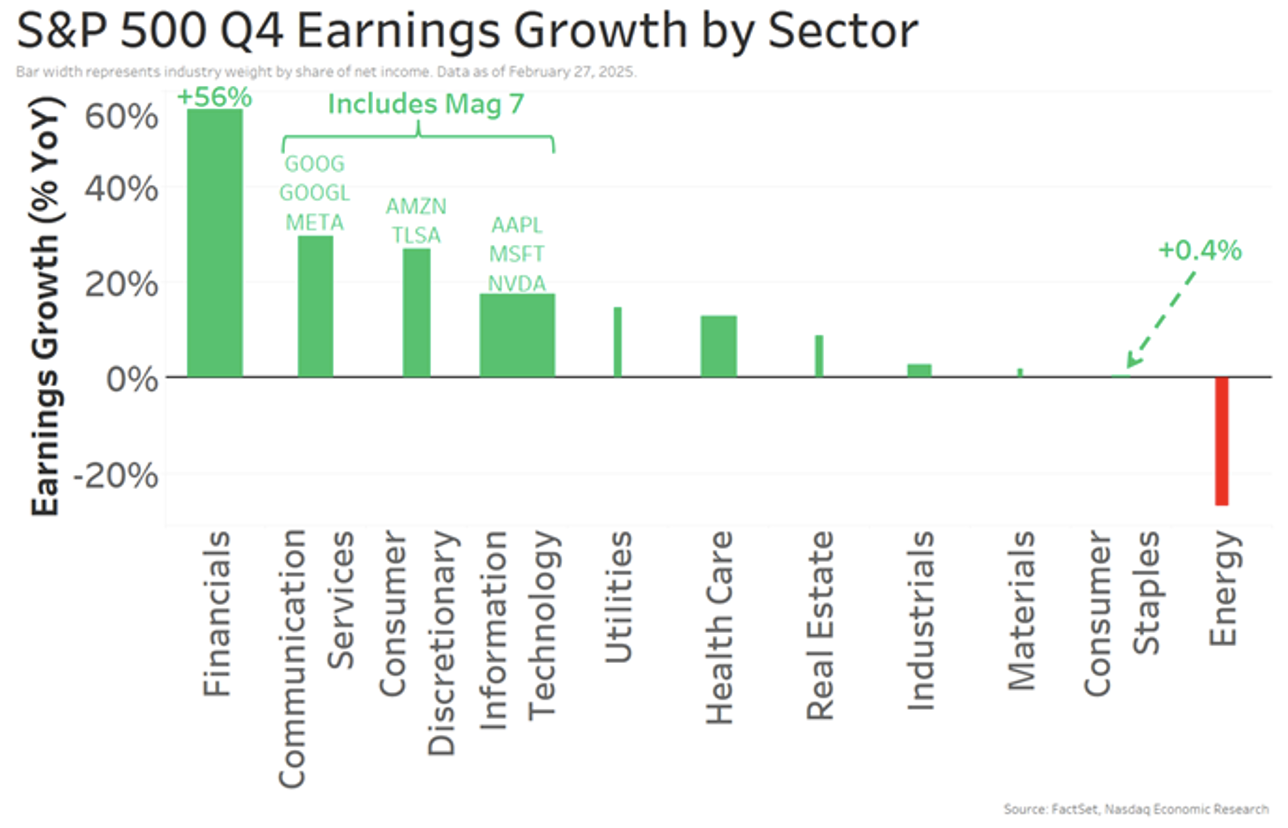

- 10 of 11 Massive-cap sectors see constructive earnings growth – most in 3 years

- Developments out of Washington proceed to dominate headlines

Index efficiency for February:

All the main U.S. equity indices declined in February. The S&P 500 remained constructive for the 12 months whereas the equal-weighted index outperformed the official index. Underperforming sectors included Tech, Client Discretionary, Communications and Industrials, whereas Client Staples, Actual Property, Vitality and Utilities carried out effectively. Treasuries noticed decrease yields, the Greenback Index dropped barely, gold rose modestly, and oil had its first month-to-month loss since November 2024.

The risk-off sentiment dominated the market as a result of a number of bearish narratives. Issues about growth and stagflation arose from softer financial readings and warmer inflation measures. Uncertainty round Trump’s trade, immigration, tax and Ukraine insurance policies added to the market’s unease. The Fed maintained a cautious stance amid a hotter CPI report and broader macro uncertainty. Commerce warfare developments performed a important position with Trump asserting tariffs on Canada, Mexico, and China, although these have been delayed pending negotiations. Analysts highlighted the slowing growth and inflationary impacts of Trump’s insurance policies, and February client confidence noticed its greatest decline since August 2021.

Financial information for January confirmed combined outcomes, with a hotter CPI report raising fears of recession and stagflation. Softer nonfarm payrolls and retail gross sales studies, together with softening housing information, added to the considerations. The ISM companies index missed expectations whereas the ISM manufacturing index was stronger. Fed Chair Powell’s Congressional testimony emphasised the need for more work on inflation and acknowledged that Trump’s feedback wouldn’t influence Fed coverage choices. Regardless of the defensive tone, there have been constructive developments together with the Home GOP passing a funds decision, January core PCE inflation assembly expectations and Treasury help following the Fed’s signaling to gradual or pause QT mid-year. Early indicators of a Ukraine peace deal have been dashed after a tense assembly between Trump and Zelensky resulted in no settlement.

Bullet abstract:

- Danger-off sentiment prevailed as a result of:

- Progress/stagflation worries with softer financial readings and warmer inflation indicators.

- Uncertainty round Trump’s trade, immigration, tax, and Ukraine insurance policies.

- Elevated retail promoting strain and prolonged positioning.

- A cautious Fed amid a hotter CPI report and macro uncertainty.

- Early indicators of a Ukraine peace deal, although no deal was signed after a tense assembly between Trump and Zelensky.

- Commerce warfare developments:

- Trump introduced tariffs on Canada, Mexico and China, however they have been delayed pending negotiations.

- Analysts flagged detrimental growth and inflationary impacts from Trump’s insurance policies.

- February client confidence noticed its greatest decline since August 2021.

- Financial information:

- Hotter January CPI report raised recession/stagflation fears.

- Softer January non-farm payrolls and retail gross sales studies.

- Housing information confirmed softening.

- January ISM companies missed expectations, whereas ISM manufacturing was stronger.

- Labor markets proceed to cool with the February 22nd Preliminary Jobless claims coming in on the highest ranges of 2025.

- January core PCE inflation was in-line with expectations.

- Fed Chair Powell’s Congressional testimony:

- Emphasised more work needed on inflation.

- Feedback from Trump won’t influence Fed’s coverage choices.

- Fed officers famous the need to stay restrictive pending higher readability on inflation and tariffs.

Sector efficiency complete return for February:

Earnings commentary:

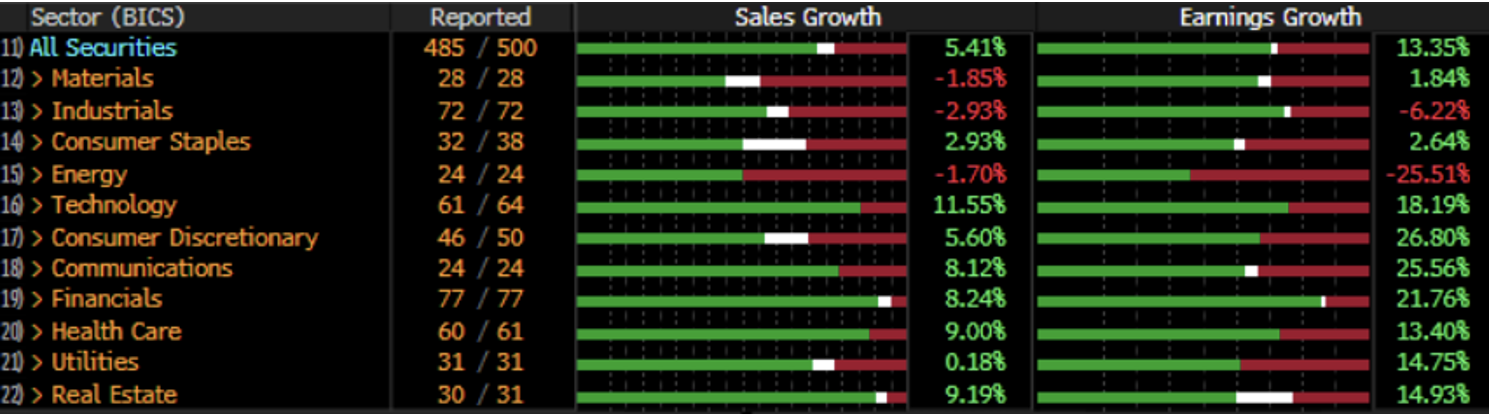

Based on FactSet information, the blended earnings growth fee for This autumn S&P 500 EPS is eighteen.2% which is increased than the anticipated 11.9%. The blended income growth fee is 5.3%. Of the 97% of S&P 500 corporations which have reported, 75% have overwhelmed consensus EPS expectations, barely under the one-year and five-year averages. Moreover, 63% have surpassed consensus gross sales expectations, simply above the one-year average however under the five-year average. Total, corporations are reporting earnings 7.5% above expectations, higher than the one-year average constructive shock fee however under the five-year average. Gross sales are 0.8% above expectations, which is under each the one-year and five-year constructive shock charges.

Gross sales and earnings outcomes by S&P sector:

Broad-based earnings growth for Massive Caps:

Two-day price response following earnings releases:

Fed Fund Futures are pricing in a 90+% probability of a maintain on the March assembly:

10-12 months Treasury Fixed Maturity Minus 2-12 months Treasury Fixed Maturity:

Gold:

Oil:

DXY:

Wanting forward:

Market’s focus this week can be on Friday’s nonfarm payrolls report for February. Economists predict the unemployment fee to stay at 4% with 160,000 new jobs added. The studying will come as new and continued jobless claims proceed to rise to begin the 12 months. There can be quite a few Fed Converse headlines over the following week forward of the March nineteenth FOMC assembly, most notably can be Chair Powell’s keynote speech on the financial outlook at Chicago Sales space’s 2025 US Financial Coverage Discussion board. Word that Q1’25 triple witch will happen on March twenty first.

Financial Calendar:

The data contained herein is supplied for informational and academic functions solely, and nothing contained herein needs to be construed as investment advice, both on behalf of a explicit security or an general investment strategy. All info contained herein is obtained by Nasdaq from sources believed by Nasdaq to be correct and dependable. Nonetheless, all info is supplied “as is” with out guarantee of any sort. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

Keep up to date with the latest news within the US markets! Our web site is your go-to source for cutting-edge financial news, market trends, financial insights, and updates on home trade. We offer each day updates to make sure you have entry to the freshest info on stock market actions, commodity costs, currency fluctuations, and main financial bulletins.

Discover how these trends are shaping the long run of the US financial system! Go to us frequently for probably the most participating and informative market content material by clicking right here. Our fastidiously curated articles will keep you knowledgeable on market shifts, investment methods, regulatory adjustments, and pivotal moments within the US financial panorama.