High 10 Charts from 2024 | U.S. Finance Information

Glad New 12 months to all our common readers!

We’re kicking off 2025 with a countdown of what we predict had been the ten most fascinating charts from our blogs in 2024.

As you’ll see, we coated a lot of totally different topics – from introductions to choices and short promoting to latency to creating markets higher for issuers and traders.

We begin our countdown at quantity 10:

10. Our first interns’ information to choices

In 2024, we added to our suite of common summer season interns’ guides. Along with introductions to market construction, how trading works and ETFs, we added a information to choices markets.

This included a lot of data, corresponding to how option payoffs work, the place the liquidity in U.S. choices markets is, and when and how every option expires (Together with a helpful desk exhibiting what choices expire within the open vs. the close, and which have bodily supply).

However my favourite chart from the weblog regarded on the “moneyness” of choices being traded. Because the chart exhibits, the bulk of choices being traded when they’re “out of the money.” That considerably reduces the premium prices (because the probability of train is decrease) and the quantity of hedging a market maker would need to do (because the delta is decrease). It additionally signifies that including up “options notional value traded” supplies a meaningless comparability to liquidity in underlying shares because the exposures and hedging are each nicely under 1-to-1.

Chart 10: Most choices are trade when they’re out of the money

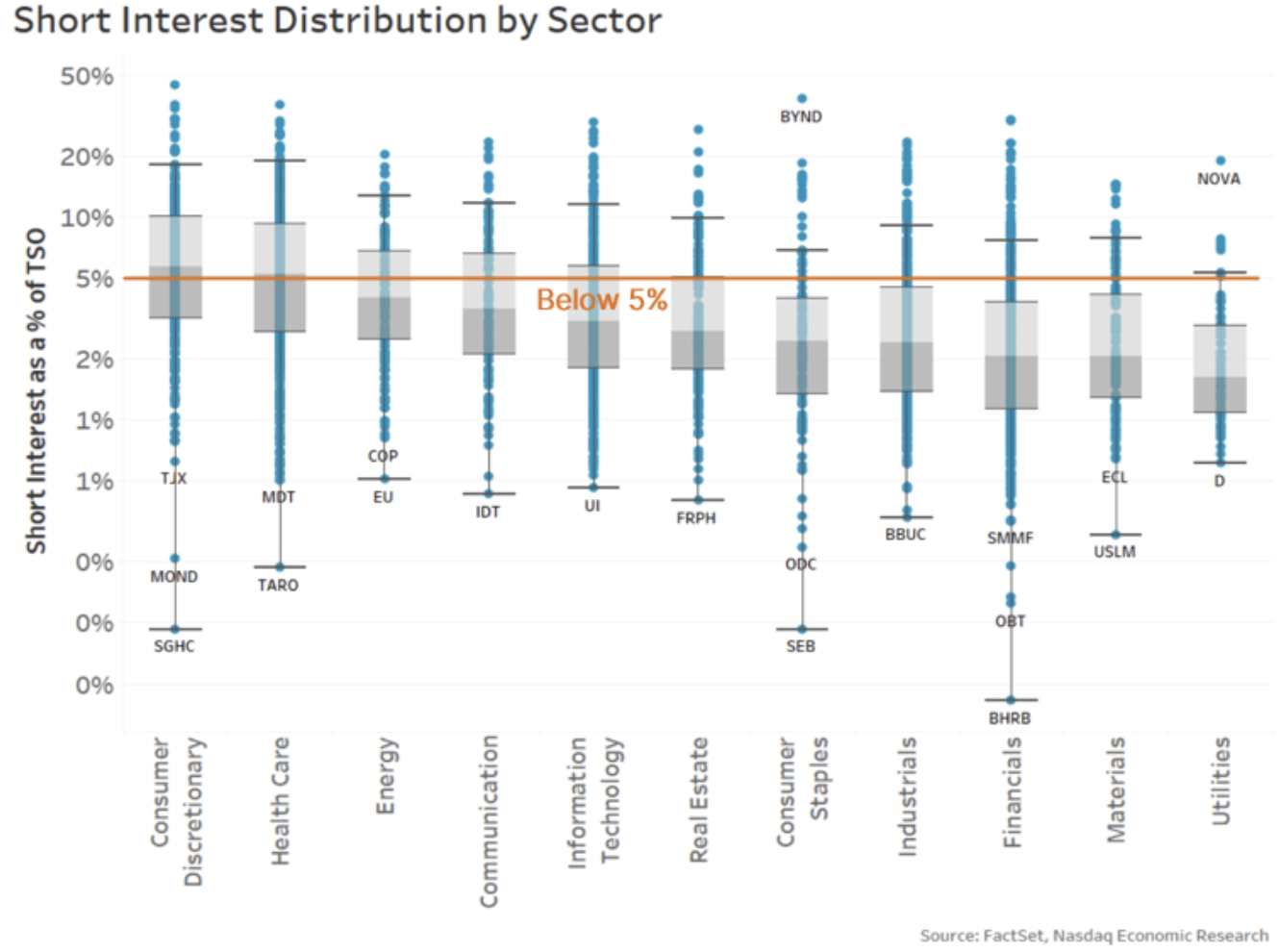

9. Brief curiosity isn’t as scary because it appears

It is truthful to say that traders and firms each don’t prefer it when their stock costs fall. Nonetheless, it’s often fallacious to focus blame on short sellers.

As we detailed in a weblog in 2024, there may be knowledge out there to help us perceive some points of short promoting.

First, we noticed that regardless of a very high proportion of trades having a “short sell” flag on them, the precise ranges of short curiosity (or holdings) within the market are usually a lot decrease and steady. Because the chart under exhibits, most shares have 5% or much less of their shares excellent held short. That confirms that the majority short promoting is finished by “bona-fide market makers” who’re required to promote and buy all day (to qualify as a market maker) and never including to directional positions.

We additionally cited guidelines that require stock to be borrowed earlier than settlement. That’s so patrons can obtain the stock they purchased from a “short” vendor – as with out that, the trade would “fail.” And knowledge exhibits that failing trades are comparatively uncommon, and most fails are for exceptionally small (most probably retail) trades.

Chart 9: Most shares have under 5% of their shares excellent shorted

It’s additionally important to notice that analysis persistently exhibits that short promoting makes markets more environment friendly. It permits for hedging and cross-market arbitrage to happen, which helps keep Futures and ETF costs appropriate and stock spreads tight.

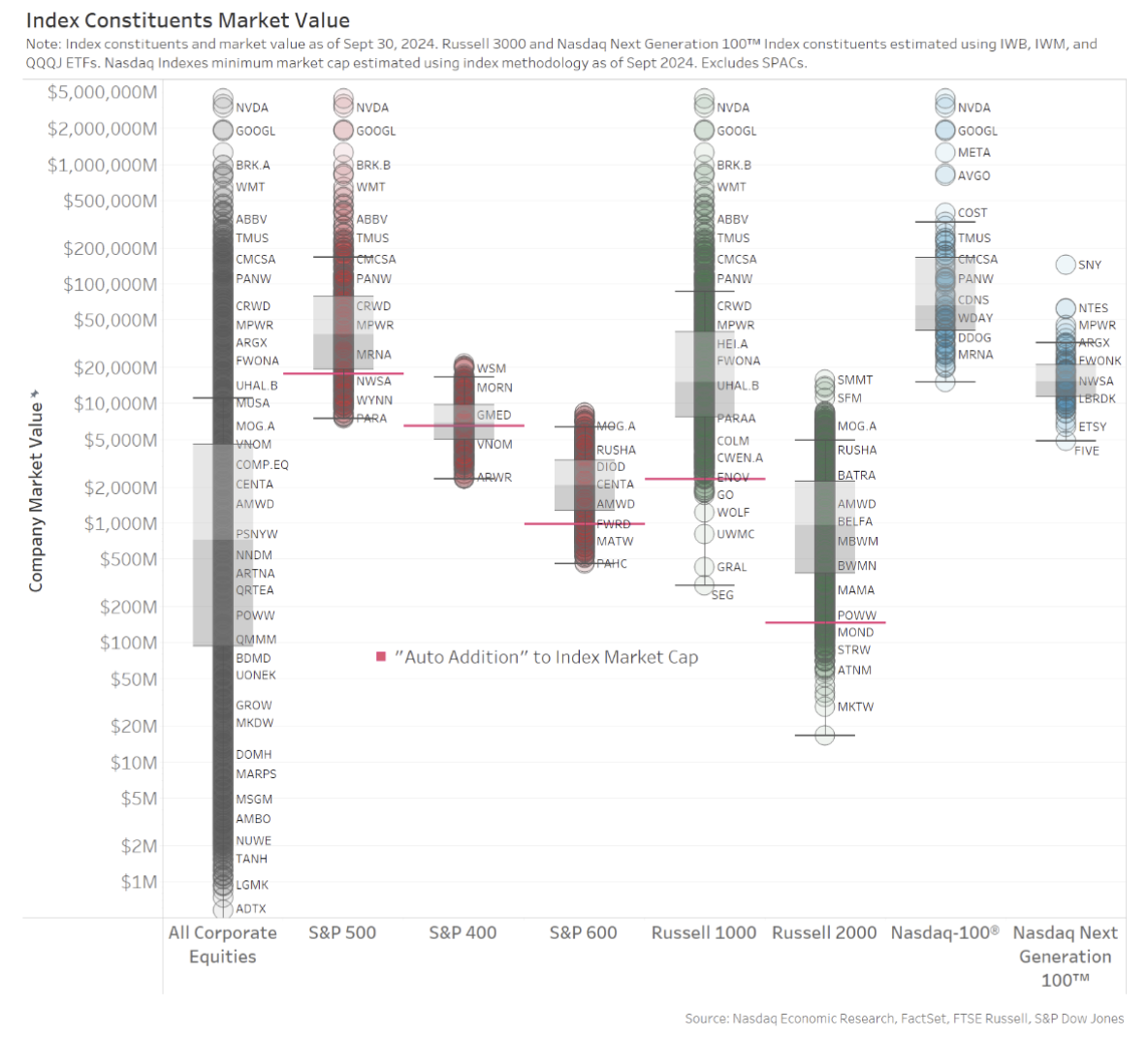

8. What defines a small-cap stock depends upon the index supplier

Individuals incessantly discuss large-, mid- and small-cap shares – as whether it is clear what corporations are included in every group.

Nonetheless, our favourite chart from that research exhibits that it may well rely a lot on which index supplier you might be utilizing. In actual fact, the chart under exhibits that some small-cap shares are bigger than the smallest large-cap shares. Though to be truthful, that’s a consequence of price modifications during the 12 months in addition to a aware choice to scale back index turnover and trading price for anybody working an index fund.

Chart 8: Shares included in several market cap indexes by index supplier

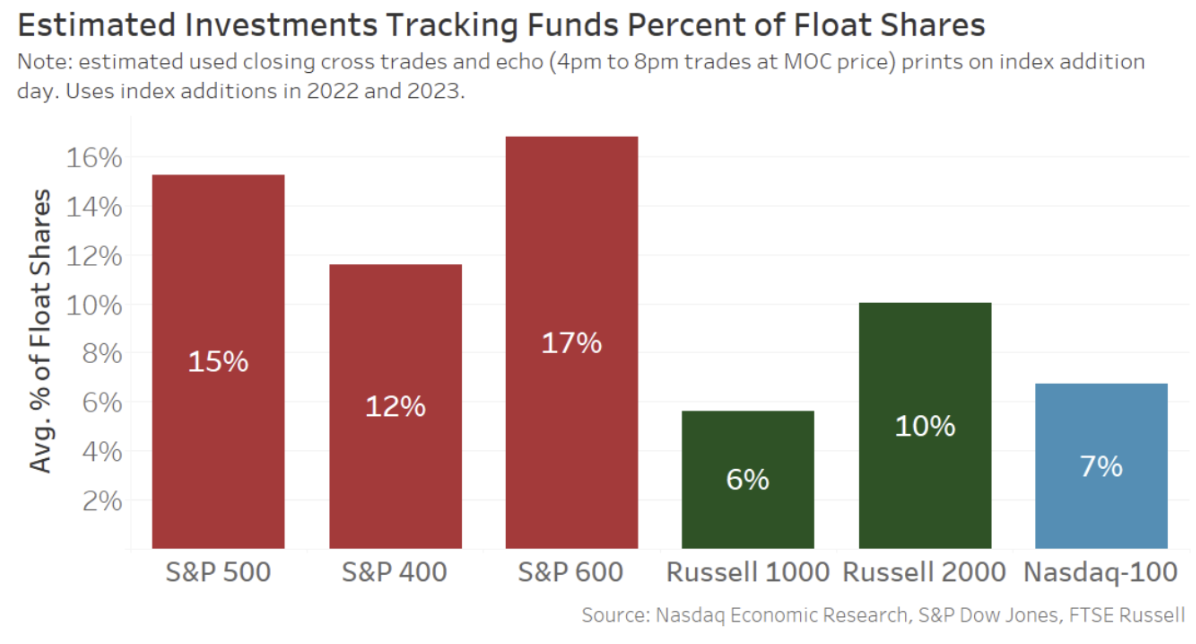

7. index trades to estimate index monitoring

Index funds and ETFs are getting more and more widespread.

In one other research, we checked out how a lot of a company’s out there shares trade within the close on an index addition date.

The outcomes had been revealing, exhibiting that the market can present a large quantity of liquidity immediately because the market closes with a view to fulfill indexer demand. That’s even more spectacular given current analysis exhibits the fee of that liquidity has been falling at the same time as index funds continued to grow.

Chart 7: The MOC is ready to soak up large quantities of liquidity on index rebalance dates

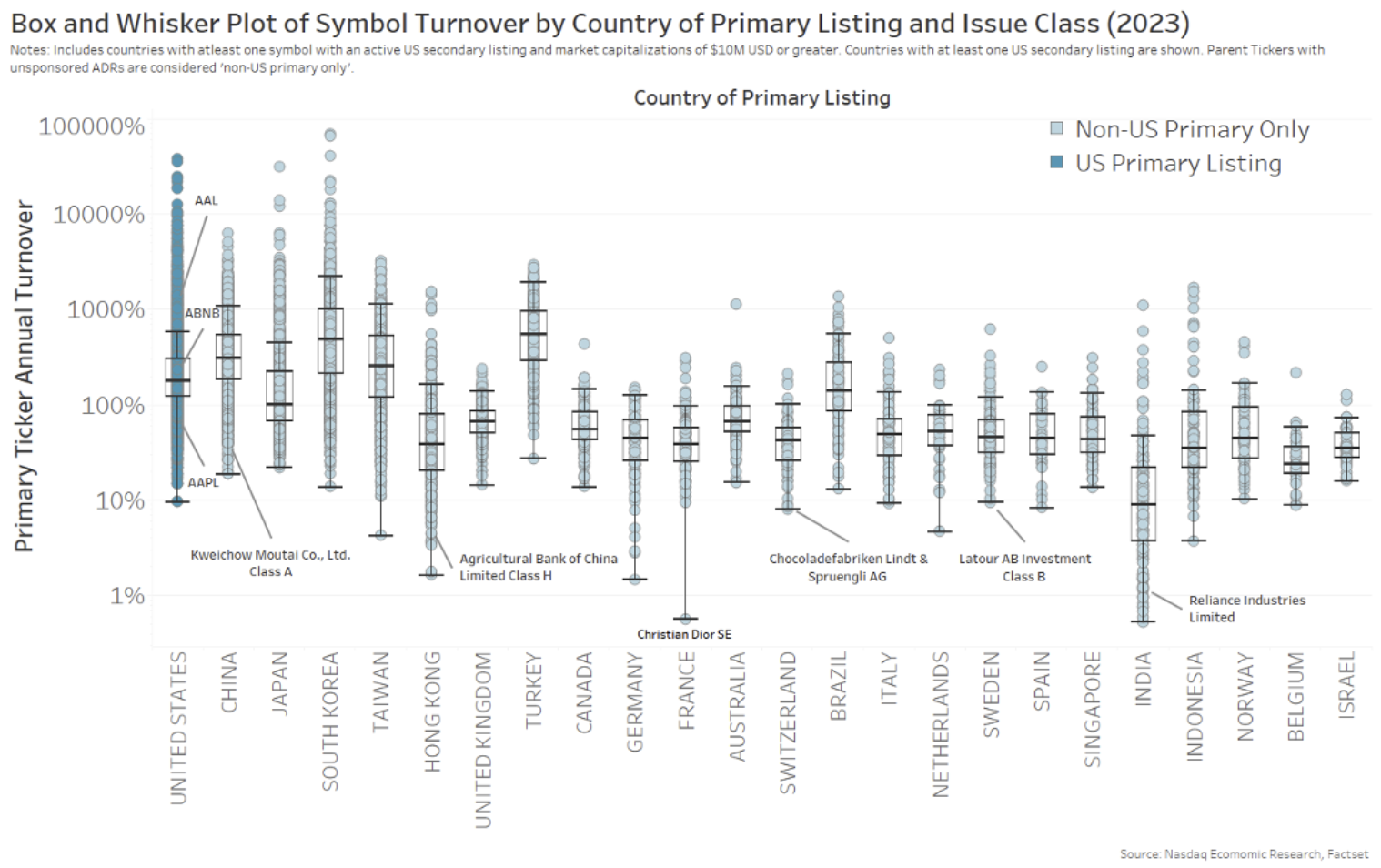

6. Is the U.S. actually probably the most liquid market within the world?

Individuals incessantly boast about how the U.S. is the most affordable, most liquid equity market to trade within the world.

Nonetheless, with roughly 6,000 corporations listed within the U.S. versus much less than 900 corporations listed in France, is it even truthful to match trading in Apple to Complete?

It is fairer if we compute the “market-cap turnover” of every company, which is measured because the instances the whole out there shares trade every year. That accounts for various share costs and market caps across the world.

The consequence (as we show within the chart under) was revealing. U.S. liquidity was good, however not the best. Notably, liquidity in a quantity of Asian international locations – with typically robust retail markets – was, on average, even higher. Though, as one other chart in that research confirmed, Asia’s bigger developed markets dragged the average for the entire area down under that of the U.S.

Chart 6: Annual market-cap turnover for every stock (by nation)

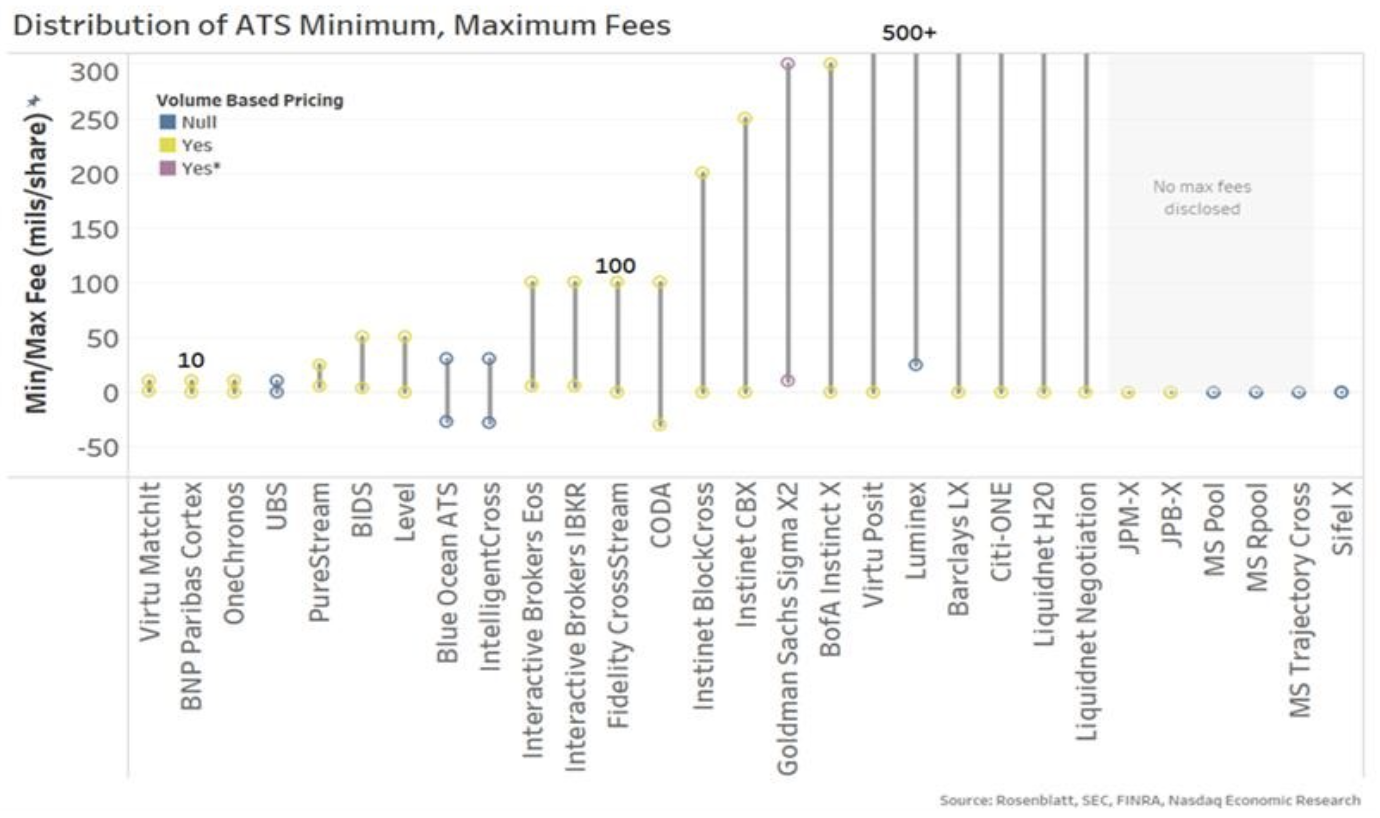

5. Exchanges charges work very in a different way to ATS’s

The U.S. Securities and Change Fee (SEC) was extraordinarily busy in 2024, finalizing a multitude of new guidelines. A number of focused exchanges and their payment constructions, together with lowering entry charges and eliminating quantity reductions for lcustomers who trade and quote a lot.

These guidelines solely affected how exchange charges work, which was ironic, provided that 2024 was additionally the 12 months that off-exchange trading handed the 50% mark (more than as soon as). That’s particularly important because it’s a stage thought-about a tipping level essential to market high quality and having an NBBO that’s significant to the market and truly protects traders.

In short, by specializing in exchange charges, the SEC missed the more and more aggressive economics of the “other half” of the market.

We’ve mentioned earlier than that equal is just not truthful. That’s one thing that appears undeniably clear if you take a look at charges charged for the SIP (which embrace quantity reductions) and how the SEC recoups its annual finances (which varies over time).

The economics of the “other half” of the market may be very totally different. Reasonably than being truthful entry and equal (just like the SEC desires for exchanges), it’s bilateral and bundled, with buyer high quality tiers and segmentation that provides to unfold seize (permitting charges to be greater). In actual fact, because the chart under from this weblog highlighted, ATSs charge a wide selection of charges – from “free” to a lot greater than the present exchange payment cap.

Both means, “ten” is clearly not the norm, nor might it’s mentioned that different charges within the market are “equal”.

Chart 5: Kind ATS-N exhibits simply how difficult market pricing is throughout (even off-exchange) venues

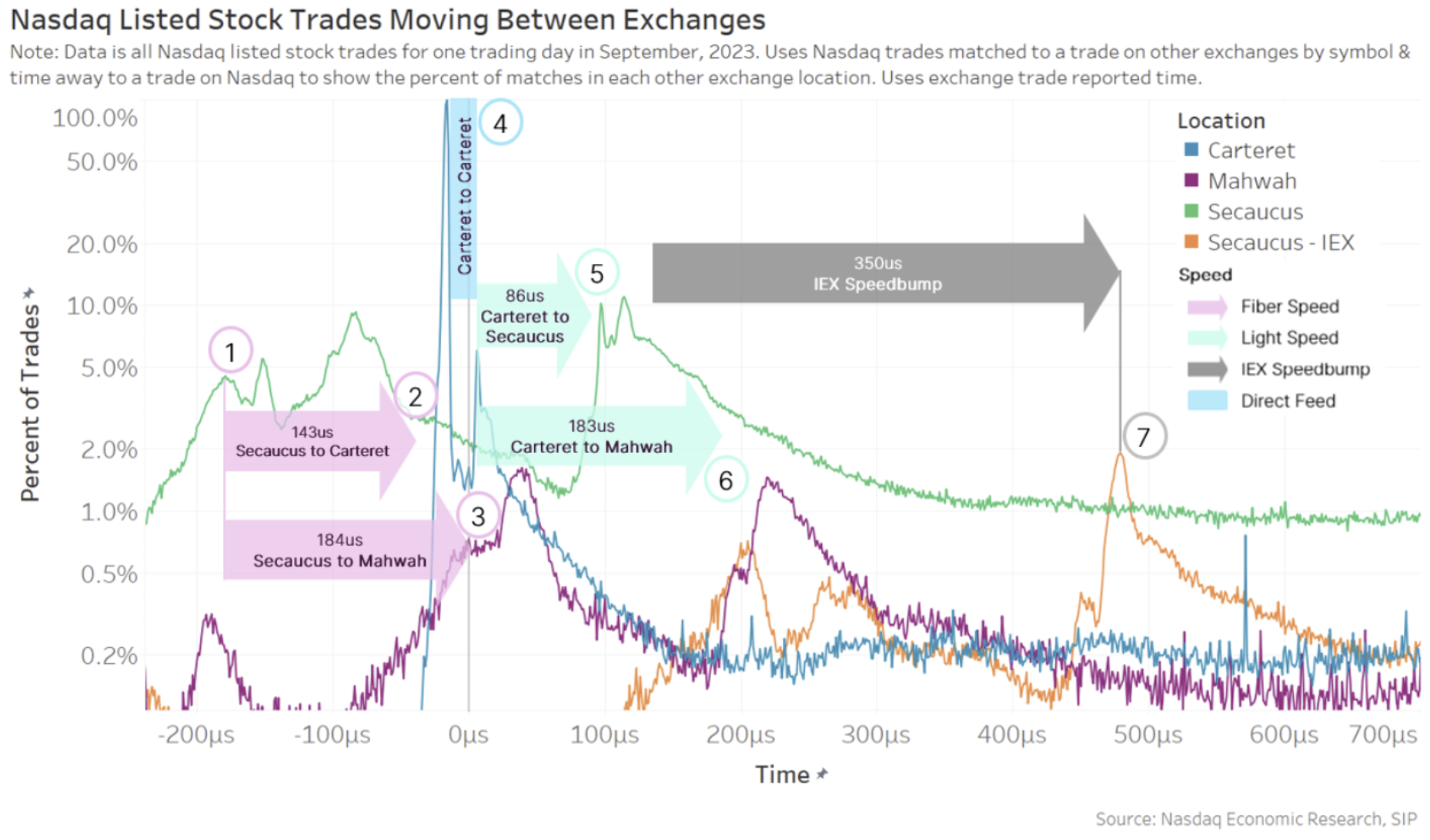

4. One millisecond is barely de minimis to a human

Years in the past, the SEC created a new “de minimis” rule designed solely to approve IEX’s velocity bump market (the identical 12 months they denied Cboe their own velocity bump proposal, which was solely fractionally slower). The SEC has since leaned on that rule to approve IEX’s D-limit (fade-able however protected) lit quotes. Satirically, the U.S. regulator declined to make use of it for figuring out an acceptable stage of latency for the SIP.

All of that historical past is related to a research of trading latency we did in 2024.

What we mentioned in that weblog was how, even on the velocity of mild, it takes time for a trade to journey across the U.S. market for fills, which occur in real-time, fractions of a second aside, inflicting reverberations throughout the market.

In actual fact, what our favourite chart from that weblog confirmed, utilizing microsecond timestamps (one-thousandth of a millisecond) is that we will see a lot of trades within the U.S. market provoke from Secaucus, the place most broker algorithms are situated. Initially, the orders from these algorithms journey at fiber velocity across the U.S. market (pink arrows), then, as fills are seen at every venue, a response appears to happen at microwave speeds (inexperienced arrows) earlier than lastly passing by way of the IEX velocity bump and trading there final, if any of their quotes haven’t, by then, been repriced.

Even with the IEX velocity bump delaying trades occurring on their venue, from begin to end, this all occurs in much less than 1 millisecond.

Chart 4: Trades journey across the U.S. market and trigger reactions that final much less than one millisecond

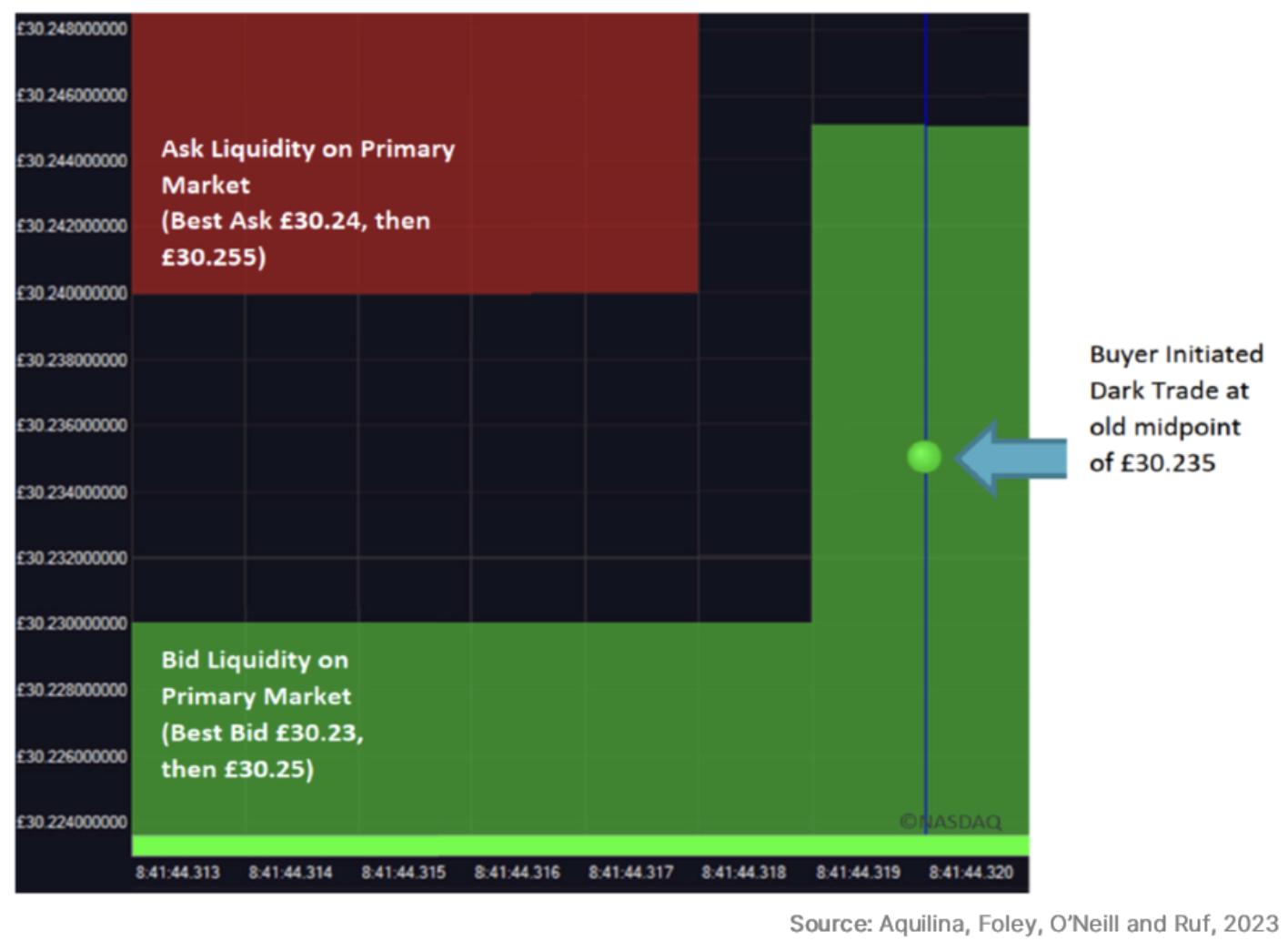

3. Latency arbitrage detected in London darkish swimming pools

What we discuss in Chart 4 above is what leads people to speak about latency arbitrage. A new educational research confirmed how this may work in follow in darkish swimming pools in the UK.

Darkish swimming pools, by design, peg orders to the quotes set by exchanges. The chart from that weblog that the majority clearly confirmed what they discovered is under. It exhibits:

- The bid on exchange growing (inexperienced shade).

- Earlier than a fill happens in a darkish pool on the “old midpoint.”

That is attainable as a result of “fast” arbitrageurs can ship a trade on microwave, whereas quotes journey on optic fiber (which has a slower velocity of mild however is more dependable).

The research discovered that “a substantial amount of stale trading occurs [in dark pools].” In addition they discovered that arbitrageurs had been on the profitable facet of the trade more than 96% of the time – shopping for on the stale midpoint whereas promoting on the major markets at a newer, greater price.

Chart 3: Darkish fills occurring at outdated midpoints because of distance-created latency

It has since been replicated throughout Europe, with analysis from Euronext, SIX Swiss and Deutsche Börse discovering related outcomes.

This research has important implications for the consolidated tape debates occurring in Europe and elsewhere.

As we’ve mentioned earlier than, all costs are delayed, and a consolidated tape will all the time be (even) slower. That’s why even our rivals say a consolidated tape ought to by no means be used for trading.

Stated one other means, a consolidated tape can by no means be pre-trade (it’s simply physics). Nonetheless, it may very well be used to quantify how a lot trading is going on at these stale quotes.

This has market construction implications, too. The fragmentation reduces the fill probability to darkish pool clients (even when a purchaser crossed the lit market unfold) but in addition makes unfold seize tougher on the first market tougher (as unfold crossers are principally more aggressive trades). The result’s worse economics for price setters and in the end wider spreads and fewer depth.

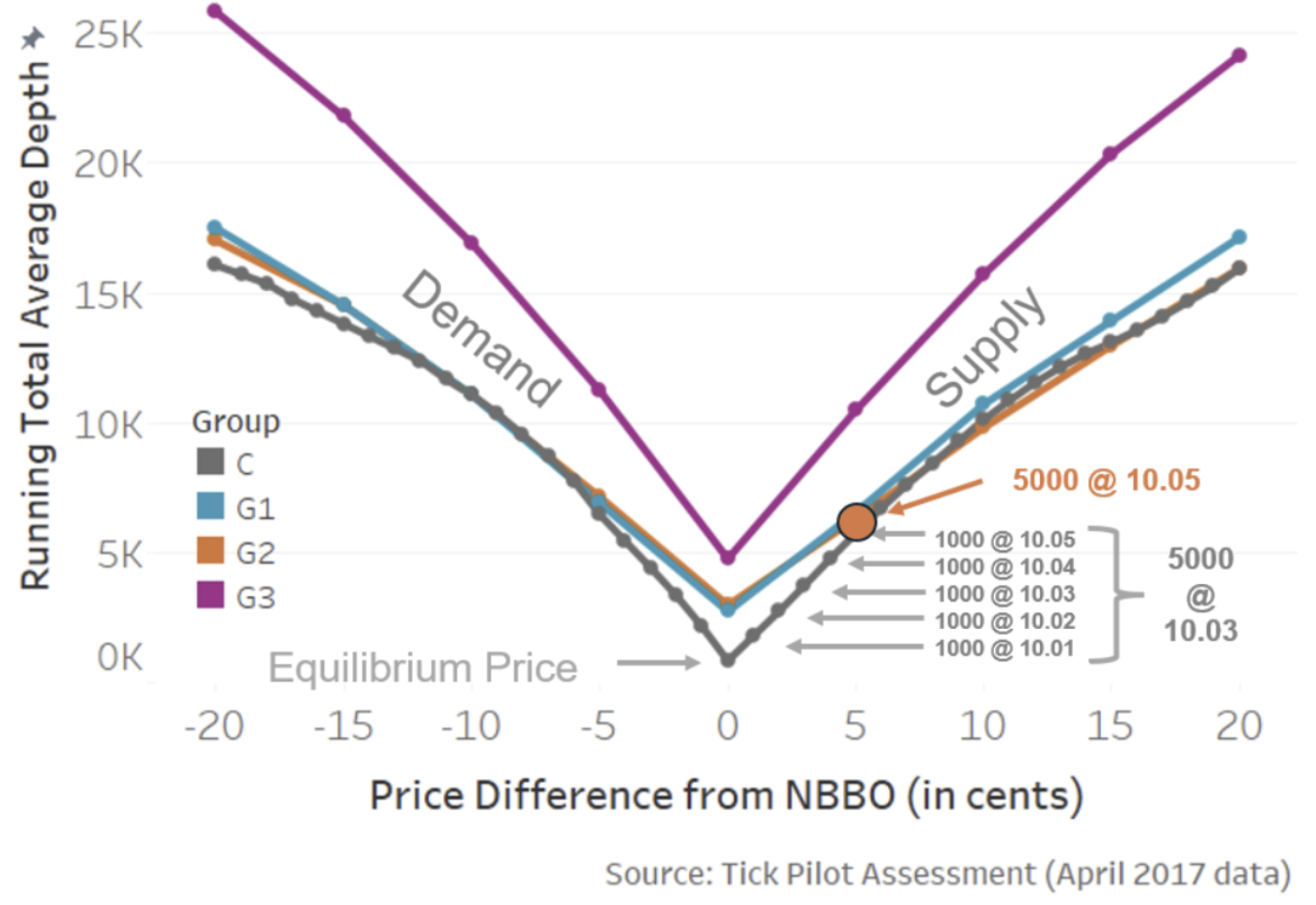

2. Depth and spreads react to primary economics of provide and demand

Tick sizes have been studied in depth by us and teachers. The findings are all fairly constant, exhibiting that the economics of spreads and depth are pushed by easy provide and demand.

Within the weblog the place we summarized these findings, probably the most related chart is the one under. It exhibits that:

- Provide and demand curves for shares are usually fairly linear.

- Lowering the tick (for tick-constrained shares) helps to scale back not solely the unfold but in addition the depth. For traders, spreads and depth are a trade-off.

Based mostly on all of the research, the one consequence that was in a position to improve each spreads and depth of the NBBO was the trade-at group within the Tick Pilot research (proven as G3 under). Apparently, that’s what occurs when the price setter will get to seize their own unfold – moderately than BBO getting used to trade elsewhere like we see in chart 3 above.

Chart 2: Analysis exhibits bettering spreads virtually all the time worsens depth; it’s a trade-off with out trade-at

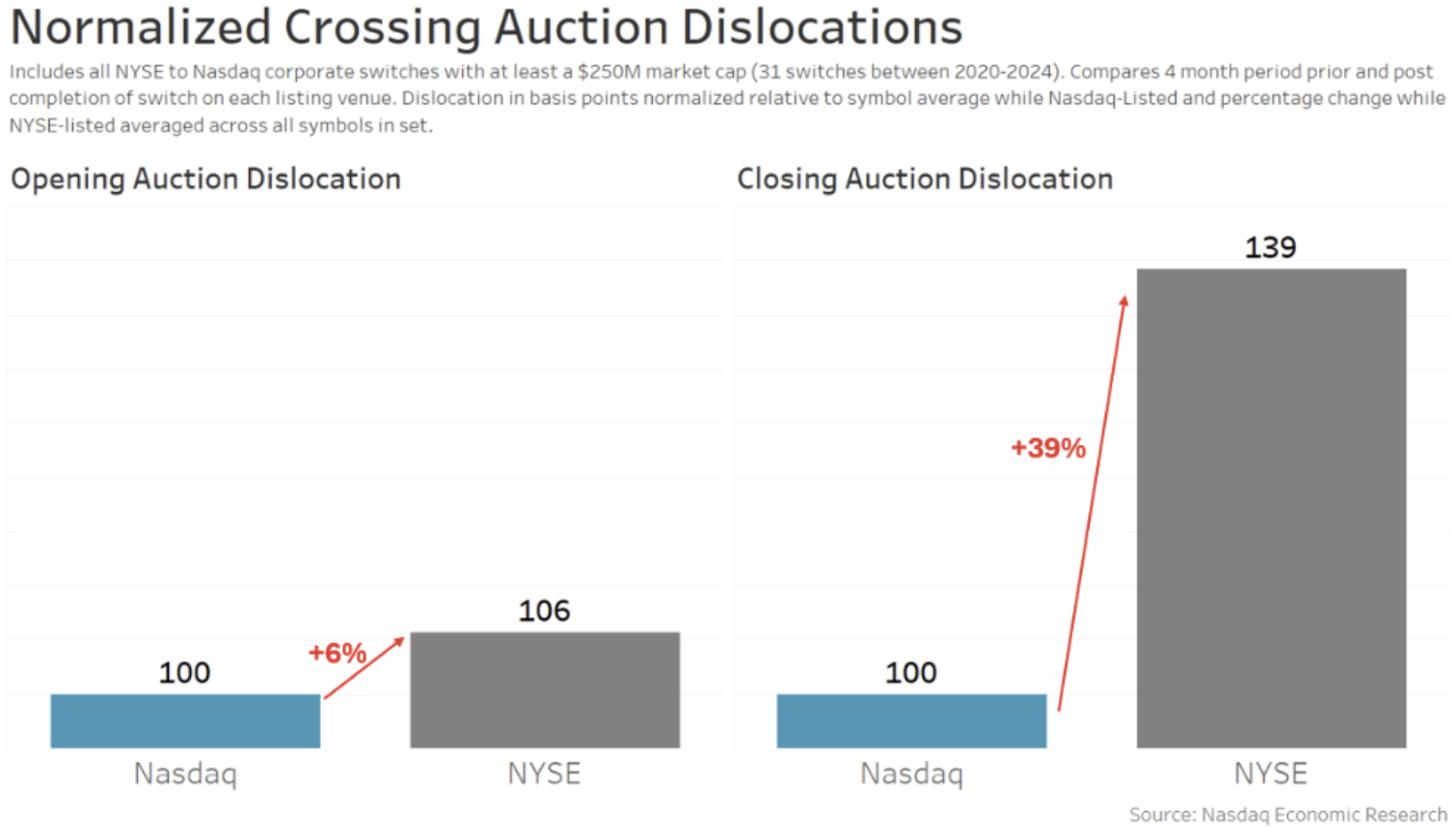

1. Nasdaq has higher auctions for issuers

Throughout 2024, we noticed the five hundredth company change from NYSE to Nasdaq.

Clearly, all of us trade in an NMS world (Nationwide Market System) with UTP (unlisted trading privileges) that means shares can trade wherever – regardless of the place they’re listed.

However after we take a look at the info, we see that Nasdaq market high quality is nonetheless higher for corporations.

Our favourite chart from that weblog regarded on the open and shutting auctions. It exhibits that totally different public sale guidelines can cut back a stock’s volatility. That’s important as a result of analysis means that it may well cut back a company’s price of capital, which ought to result in further investments and returns for traders. This, in flip, is sweet for the U.S. financial system.

Chart 1: Switches have decrease public sale volatility on Nasdaq

We hope everybody had a comfortable and healthy vacation season. We’re wanting ahead to bringing more new and fascinating insights all through 2025.

Keep up to date with the latest news within the US markets! Our web site is your go-to source for cutting-edge financial news, market trends, financial insights, and updates on home trade. We offer each day updates to make sure you have entry to the freshest data on stock market actions, commodity costs, currency fluctuations, and main financial bulletins.

Discover how these trends are shaping the long run of the US financial system! Go to us often for probably the most partaking and informative market content material by clicking right here. Our fastidiously curated articles will keep you knowledgeable on market shifts, investment methods, regulatory modifications, and pivotal moments within the US financial panorama.